What is Gift Aid?

The Gift Aid Scheme was originally introduced in 1990 to allow charities to claim back tax from donations.

Donations by individuals to charity or to community amateur sports clubs (CASCs) are tax free.

For every £1 donated, 25p can be reclaimed by charities – at no extra cost to the donor.

A donation qualifies for Gift Aid if:

- It is a gift to a charity

- It is a ‘payment of a sum of money’

- The individual making the donation has paid, or will pay, UK tax

How does Gift Aid work?

When someone makes a Gift Aid donation, the money they donate has already been taxed.

The charity will take your donation and then reclaim from HMRC the 20% tax that you originally paid.

Is Gift Aid 20% or 25%?

The UK basic rate tax is currently 20% so a £1 donation is treated as the net amount after tax has been applied. The £1 donation is technically derived from £1.25. Start with £1.25, minus 20% tax and you have £1.

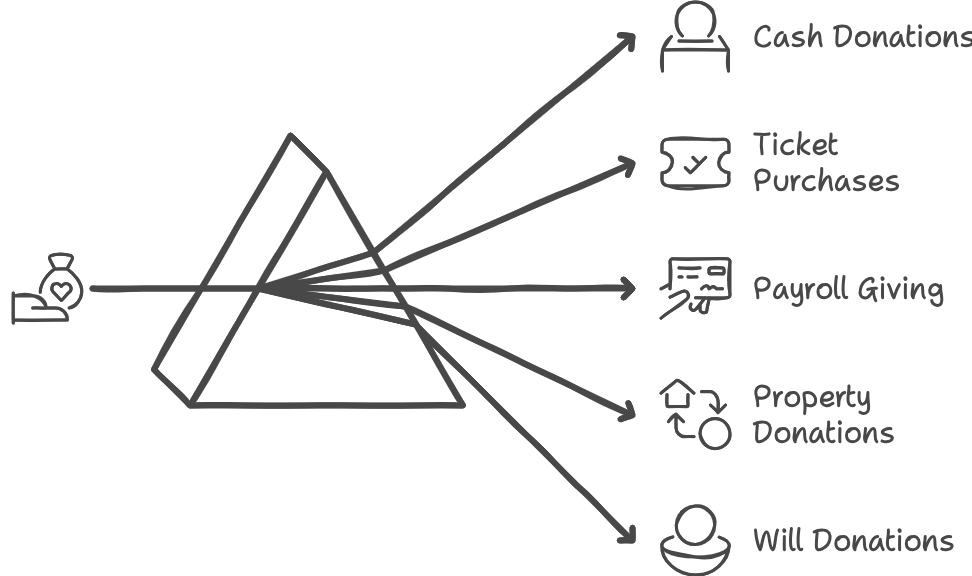

Which donations can Gift Aid be claimed on?

Charities can accept donations in a number of ways and claim Gift Aid.

These include:

- Donations – cash / online

- Purchases – tickets, shop items

- Straight from wages, pension or a Payroll Giving scheme

- Land, property or shares

- In a will

This also applies to sole traders and partnerships but there are different rules for limited companies.

You can find more in-depth information on Gov.UK

https://www.gov.uk/government/publications/charities-detailed-guidance-notes/chapter-3-gift-aid#chapter-31-introduction